Useful for enthusiasts, investors, commercial, management, production and supply chain professionals.

Actinium‑225 (Ac‑225) is a highly sought-after radionuclide for targeted alpha therapy (TAT), an emerging cancer treatment modality. This report outlines the calculations for the projected demand of Ac-225 based targeted radiotherapies for which several clinical trials are underway, with start of approvals expected in the next 2-3 years leading to substantial surge in the demand for Ac-225 radioisotope.

About Actinium‑225

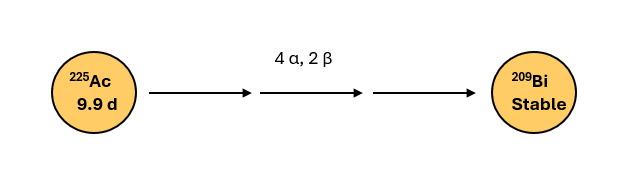

Actinium‑225 is an Actinide series radioisotope with a half-life of approximately 9.9 days. It decays by the emission of four α particles and two β– particles to stable Bismuth-209; α emission is the predominant mode of decay, illustrated in Figure 1 below.

Figure 1: Particle emissions in Ac-225 decay chain

The α particles Ac-225 emits are considerably heavier and higher energy (5.8-8.4 MeV) compared to β particles, and inflict higher degree of damage to cancer cells while minimizing the impact to normal cells due to their short travel path in the tissues. These characteristics make AC-225 attractive for targeted radiotherapy, particularly for targeting micrometastatic oncologic lesions (detailed description of α particle characteristics here).

Ac-225 global demand calculations

Demand for Ac-225 in the nuclear medicine stems from:

(a) Clinical trials

(b) Preclinical R&D

(c) Therapeutic application

- (a) Clinical trials

As of May 2025, there are at least 13 active and recruiting clinical trials for Ac‑225-labeled agents registered in the US with clinicaltrials.gov, covering indications such as metastatic castrate resistant prostate cancer (mCRPC), neuroendocrine (NET) tumors, leukemia and others. While these trials include US and some international studies, additional trials are registered in other regions, e.g., EU and China.

Based on the information from clinicaltrials.gov database, there are about 920 patients currently targeted for enrollment for phase 1-3 trials; majority of the recruitment is for phase 1 and phase 2 trials and prostate cancer is the major treatment indication.

We assume current worldwide enrollment target to be ~1000 patients, our best guesstimate based on the information from trials outside US.

The requirement of Ac-225 varies with indication, patient weight, phase of a clinical trial and number of treatment cycles planned. Information on these variants is not available, therefore some generalized assumptions were required for the estimation of Ac-225 calculations. As the estimate depends on the assumptions, our estimate may differ significantly from other estimates. However, this exercise would provide an approximate idea for the Ac-225 requirement. The assumptions for the calculations were:

- Prostate cancer assumed as the treatment indication

- Average patient weight 75 kg

- treatment cycles assumed for phase 2, and phase 3 were 4 and 4.5; phase 3 treatment cycles assumed were 3-6 with average of 4.5 cycles

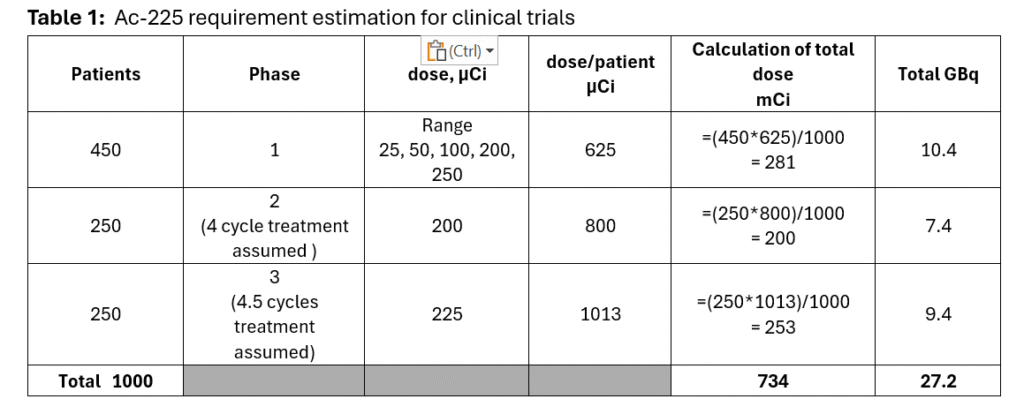

- Patients and doses were assigned based on available data, shown in Table 1 below.

Table 1 describes the calculation of Ac-225 requirement per patient and total dose required for all patients.

The total requirement of Ac-225 calculates to be under 1 Ci, at ~ 734 mCi or 27.2 GBq, a relatively small amount.

Evan if this estimate differs significantly from other estimates, it may not affect the investments for production capital requirement as activity of Ac-225 required for clinical trials is smaller.

- (b) Preclinical R&D requirement calculation

Research groups and preclinical work consume Ac‑225, although at far lower scale compared to clinical trials. We assume this requirement to be 5-10% of the clinical requirement. This assumption provides Ac-225 requirement for this category at ~ 37-73 mCi or 1.3- 2.7 GBq.

- (c) Therapeutic application requirement calculation

For simplicity, this calculation is performed for prostate cancer indication only. About 313,000 new cases of prostate cancer are expected in 2025, and 8% of those, ~ 25000, are estimated to be mCRPC (ref). The ongoing clinical trials registered with clinicaltrials.gov include patients for first line as well as other lines of treatment. Among phase III trials, Ac-225 prostate cancer trials are farthest along, and are likely to be approved in 2027-2028, with SSTR biomarker targeted NET therapy approvals expected to follow in 2029-2030.

Comparing the targeted clinical trial participants and estimated mCRPC cases/year, the patient pool for even considering only prostate cancer therapy is substantially greater and would require substantially higher amount of Ac-225 for the treatment.

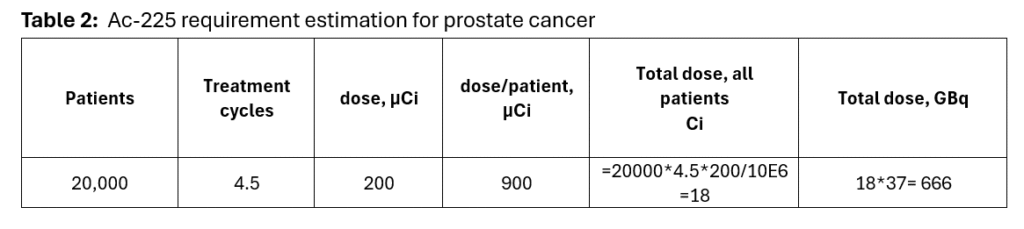

For calculation, let us assume 20,000 mCRPC patients are treated yearly (every year 25,000 new mCRPC patients are expected). The Ac-225 calculation makes these assumptions:

- average dose per patient 200 μCi

- average number of cycles required per patient is 4.5 (average of 3 and 6 treatment cycles based on the range of 3-6 cycles)

The dose calculation for this category is shown in Table 2.

The calculations project Ac-225 demand to be ~ 18 Ci/year, about 25 times higher than the demand for clinical trial quantities. This demand would increase with larger patient pool, and inclusion of other indications.

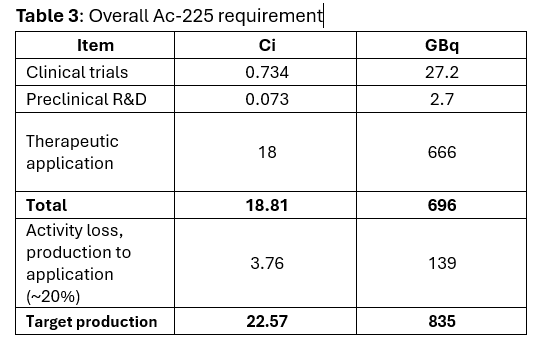

Net demand for the three categories combined, based on the calculations, is:

As Ac-225 loses activity post-production during transport and until patient treatment, a loss of 20% activity is assumed (corresponding to average of 2 days between production and patient treatment).

This exercise shows that for the scenarios discussed, 835 GBq or 22.5 Ci of activity needs to be manufactured.

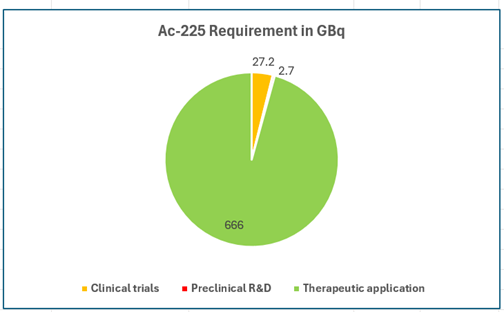

Graphical representation of the Ac-225 requirements is shown below:

There are commercial manufacturers of Ac-225 that are targeting to establish substantial manufacturing capacity in the next few years. E.g. PanTera, Belgium, targets supply of ~ 100 Ci n.c.a. Ac-225/year from 2028; NorthStar Medical Radioisotopes, Beloit, WI, targets manufacture of ~ 200 Ci/year of n.c.a. Ac-225 at full capacity in the next few years. These quantities, if become available as projected, would be easily able to meet the Ac-225 demand for radiotherapies.

Thus, future for meeting the expected surge in Ac-225 demand looks promising!